A SUSTAINABLE INVESTMENT LOCATION

At Bao Minh, we always prioritize and offer green and sustainable values to our valued customers.

STRATEGIC LOCATION – A LOGISTICS HUB IN THE SOUTHERN RED RIVER DELTA REGION

Bao Minh Industrial Park boasts a rare strategic location in the southern Red River Delta, serving as a crucial transit point between Hanoi, the seaport system, international airports, and border crossings.

This location helps businesses optimize logistics costs, shorten transportation times, and improve supply chain efficiency.

Transportation connectivity

-

Located approximately 90 km from Hanoi, providing quick access to the national economic and administrative center.

-

Located approximately 120 km from Hai Phong, offering convenient import and export opportunities via the international seaport system.

-

Easily connected to Noi Bai and Cat Bi international airports and major expressways.

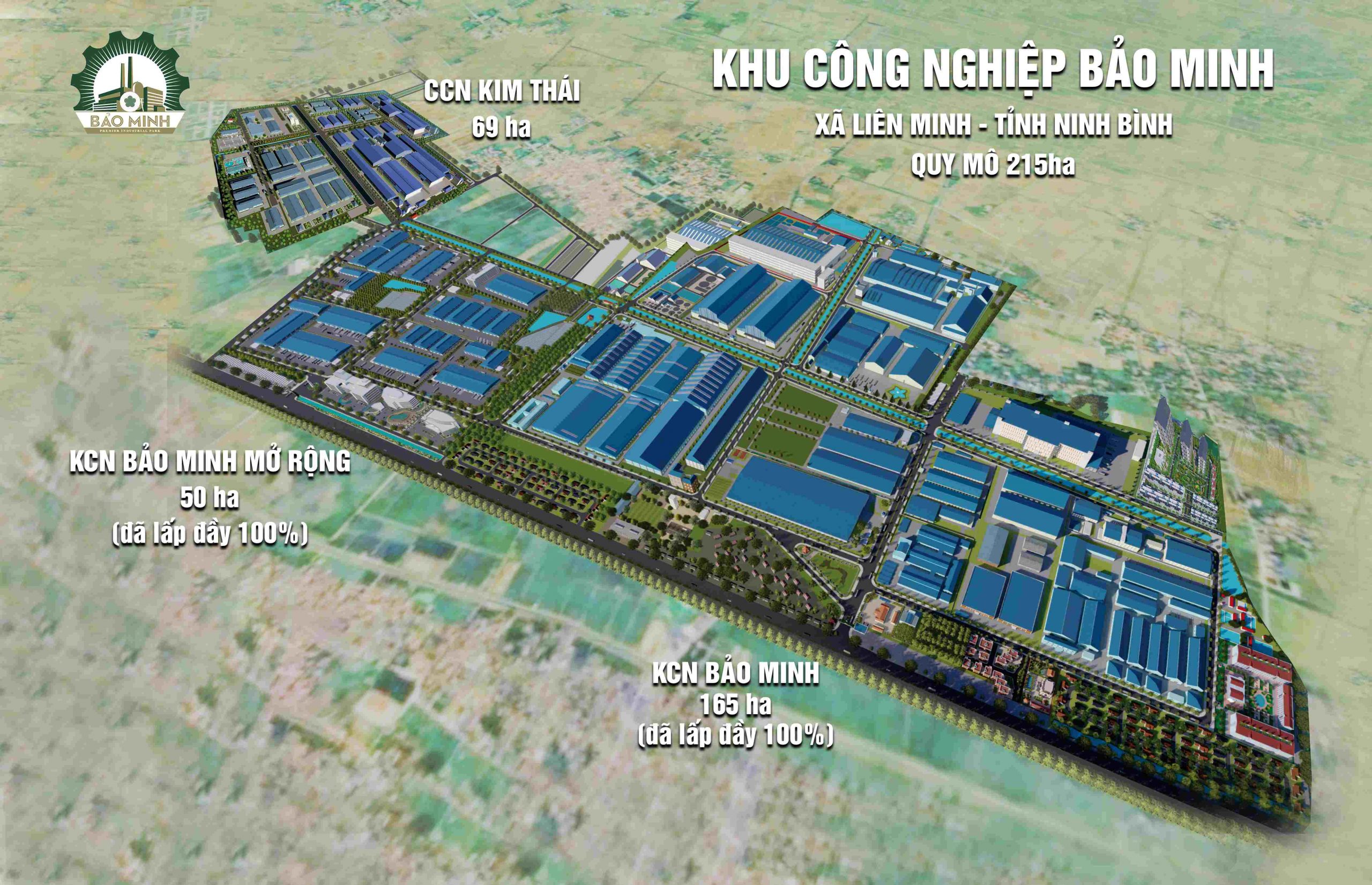

PLANNING & LAND DIVISION MAPS

BAO MINH INDUSTRIAL PARK – 165 HECTARES

Phase 1 | Completion & Stable Operation

- Occupancy rate: 100%

- Efficiently functioning manufacturing and supporting industry ecosystem

- Foundation for subsequent expansion phases

BAO MINH INDUSTRIAL PARK EXPANSION – 50 HECTARES

Successful expansion | High market demand

- Occupancy rate: 100%

- Following the completion of Phase 1 infrastructure with equivalent effectiveness

- Confirming planning capabilities and investment attraction

KIM THAI INDUSTRIAL CLUSTER – 69 HECTARES

New land fund | Investment opportunities are available

- Integrated infrastructure, well-planned layout

- Flexible land plots, suitable for various business models

- Ideal choice: clean land, clear legal status, reasonable costs

NFRASTRUCTURE

Electrical system

- 110 kV Substation in the Industrial Park

- Capacity: 50 MVA

- Can be connected to the Bao Minh Industrial Park Phase 1-2 system (total 300 MVA)

- Ensures stable power supply to each plot of land.

Water supply system

- The only industrial park in Ninh Binh with an independent clean water plant.

- Capacity: 40,000 m³/day

- Ready to supply the entire industrial park.

Wastewater treatment system

- Leading-edge technology in Vietnam

- Capacity: 5,000 m³/day

- Suitable for a wide range of industries

Social housing

- Integrated residential area

- Full amenities: kindergarten, supermarket, restaurants, laundry, sports field…

CORPORATE INCOME TAX INCENTIVE POLICY

01. Corporate income tax

- Tax-free for the first 2 years.

- 50% tax reduction for the following 4 years.

02. Exemption from import and export taxes

- Goods that constitute fixed assets

- Raw materials, supplies, and accessories that cannot be produced domestically, with a 5-year import tax exemption period.

03. Exemption from annual land tax

- Land tax exemption for 15 years.

CUSTOMER SERVICE

1. Factory design and construction consulting

2. Rental/Sale of RBF – RBW – BTS

3. Factory Fittings

4. Fire Protection and Prevention (Consulting – Approval – Acceptance)

5. Legal Consulting & Investment Procedures

6. Accommodation for experts and workers

7. Industrial Park Management & Operation

8. Human Resources & Accounting Services

STRATEGIC LOCATION

Hai Long Industrial Park borders the Tra Ly River, has direct access to the coastal expressway and national highway system, making it convenient for import, export, and logistics.

Outstanding connectivity

- Cat Bi Airport: ~33 km

- Hai Phong Port: ~40 km

- Cai Lan Port: ~90 km

- Hanoi: ~130 km

- Noi Bai Airport: ~140 km

- Lang Son: ~285 km

- Thai Binh City: ~30 km

- Nam Dinh City: ~50 km

CORPORATE INCOME TAX INCENTIVE POLICY

01. Corporate income tax

- Tax-free for the first 2 years.

- 50% tax reduction for the following 4 years.

02. Exemption from import and export taxes

- Goods that constitute fixed assets

- Raw materials, supplies, and accessories that cannot be produced domestically, with a 5-year import tax exemption period.

03. Exemption from annual land tax

- Land tax exemption for 15 years.

CUSTOMER SERVICE

1. Factory design and construction consulting

2. Rental/Sale of RBF – RBW – BTS

3. Factory Fittings

4. Fire Protection and Prevention (Consulting – Approval – Acceptance)

5. Legal Consulting & Investment Procedures

6. Accommodation for experts and workers

7. Industrial Park Management & Operation

8. Human Resources & Accounting Services

STRATEGIC LOCATION

Bao Minh Industrial Park boasts a rare strategic location in the southern Red River Delta, serving as a crucial transit point between Hanoi, the seaport system, international airports, and border crossings.

This location helps businesses optimize logistics costs, shorten transportation times, and improve supply chain efficiency.

Fast connectivity – Optimized logistics:

- Located approximately 90 km from Hanoi, providing quick access to the national economic and administrative center.

- Located approximately 120 km from Hai Phong, offering convenient import and export opportunities via the international seaport system.

- Easily connected to Noi Bai and Cat Bi international airports and major expressways.

Planning and land subdivision maps

BAO MINH INDUSTRIAL PARK – 165 HECTARES

Status: 100% occupied

This is a first-phase industrial park, attracting many manufacturing businesses that are operating stably.

BAO MINH INDUSTRIAL PARK EXPANSION – 50 HECTARES

Status: 100% Occupied

Following the success of Phase 1, the expansion quickly achieved a 100% occupancy rate.

KIM THAI INDUSTRIAL CLUSTER – 69 HECTARES

Status: Newly developed land

Well-planned layout, flexible plot sizes, suitable for businesses seeking new investment opportunities.

Infrastructure

Electrical system

- 110 kV Substation in the Industrial Park

- Capacity: 50 MVA

- Can be connected to the Bao Minh Industrial Park Phase 1-2 system (total 300 MVA)

- Ensures stable power supply to each plot of land.

Water supply system

- The only industrial park in Ninh Binh with an independent clean water plant.

- Capacity: 40,000 m³/day

- Ready to supply the entire industrial park.

Wastewater treatment system

- Leading-edge technology in Vietnam

- Capacity: 5,000 m³/day

- Suitable for a wide range of industries

Social housing

- Integrated residential area

- Full amenities: kindergarten, supermarket, restaurants, laundry, sports field…

CORPORATE INCOME TAX INCENTIVE POLICY

01. Corporate income tax

- Tax-free for the first 2 years.

- 50% tax reduction for the following 4 years.

02. Exemption from import and export taxes

- Goods that constitute fixed assets

- Raw materials, supplies, and accessories that cannot be produced domestically, with a 5-year import tax exemption period.

03. Exemption from annual land tax

- Land tax exemption for 15 years.

CUSTOMER SERVICE

1. Factory design and construction consulting

2. Rental/Sale of RBF – RBW – BTS

3. Factory Fittings

4. Fire Protection and Prevention (Consulting – Approval – Acceptance)

5. Legal Consulting & Investment Procedures

6. Accommodation for experts and workers

7. Industrial Park Management & Operation

8. Human Resources & Accounting Services

PRODUCTS AND SERVICES

The Bao Minh Industrial Park was established as part of the national textile and garment industry development strategy of the Vietnam Textile and Garment Group (Vinatex), in conjunction with the government’s industrial park planning and the local industrialization orientation, gradually becoming a center for industrial development.

LIST OF STRATEGIC PARTNERS

At Bao Minh, we always prioritize and offer green and sustainable values to our valued customers.